Understanding the Influence of Cultural Distances in International Business

The Influence of Culture on Cross-Border M&A

In December 2024, I completed my Master of Science in Intercultural Business Studies at Philipps-Universität Marburg, submitting my thesis titled

“The Effect of Cultural Distance on Overpayment in Cross-Border M&A: A Comparative Analysis through German and Japanese Case Studies.”

Supervised by Prof. Dr. Torsten Wulf, the research explored how cultural differences shape financial decision-making and valuation in international mergers and acquisitions.

“Culture influences strategy not only through communication but through perception of value itself.”

Research Context

Cross-border mergers and acquisitions (M&A) have become a key strategic tool for companies navigating globalization. Yet, their success is not merely financial—it depends on cultural understanding.

My thesis focused on how cultural distance between acquirer and target firms influences the tendency to overpay, comparing cases from Japan and Germany.Du

I examined six major outbound transactions—three from Japan (e.g., Softbank–ARM, Takeda–Shire, MUFG–Danamon) and three from Germany (Bayer–Monsanto, Siemens–Dresser Rand, Deutsche Bank–Numis).

Through these cases, I analyzed:

- Acquisition premiums and valuation logic

- Cultural patterns using Hofstede’s framework and Erin Meyer’s Culture Map

- Strategic motives and market reactions drawn from company reports, filings, and financial media

Findings

The analysis revealed distinct national tendencies:

- Japanese acquirers — driven by long-term vision, hierarchy, and collectivism — tended to overpay more often, reflecting cultural values of commitment and harmony.

- German acquirers, shaped by direct communication and risk-aversion, showed more rational pricing, though cultural friction still affected post-merger integration.

This suggests that cultural distance—as measured by behavioral and societal dimensions—acts as a subtle but real driver of overpayment risk.

“Where cultures diverge, perceptions of value follow.”

The findings emphasized that understanding the soft factors of culture is crucial in financial negotiations, integration, and due diligence.

Beyond metrics, culture determines how managers interpret success, trust, and risk.

Methodology

I employed a multiple case study approach (Yin, 2018) to ensure depth of analysis.

Each case was assessed for:

- Strategic rationale and deal context

- Financial outcomes (EPS, P/E ratio, goodwill)

- Cultural alignment between acquirer and target

Data were collected from Bloomberg, Reuters, Handelsblatt, and corporate financial reports.

Cultural metrics were computed using Hofstede indices and The Culture Map’s relative distance model, allowing comparison between workplace and societal dimensions.

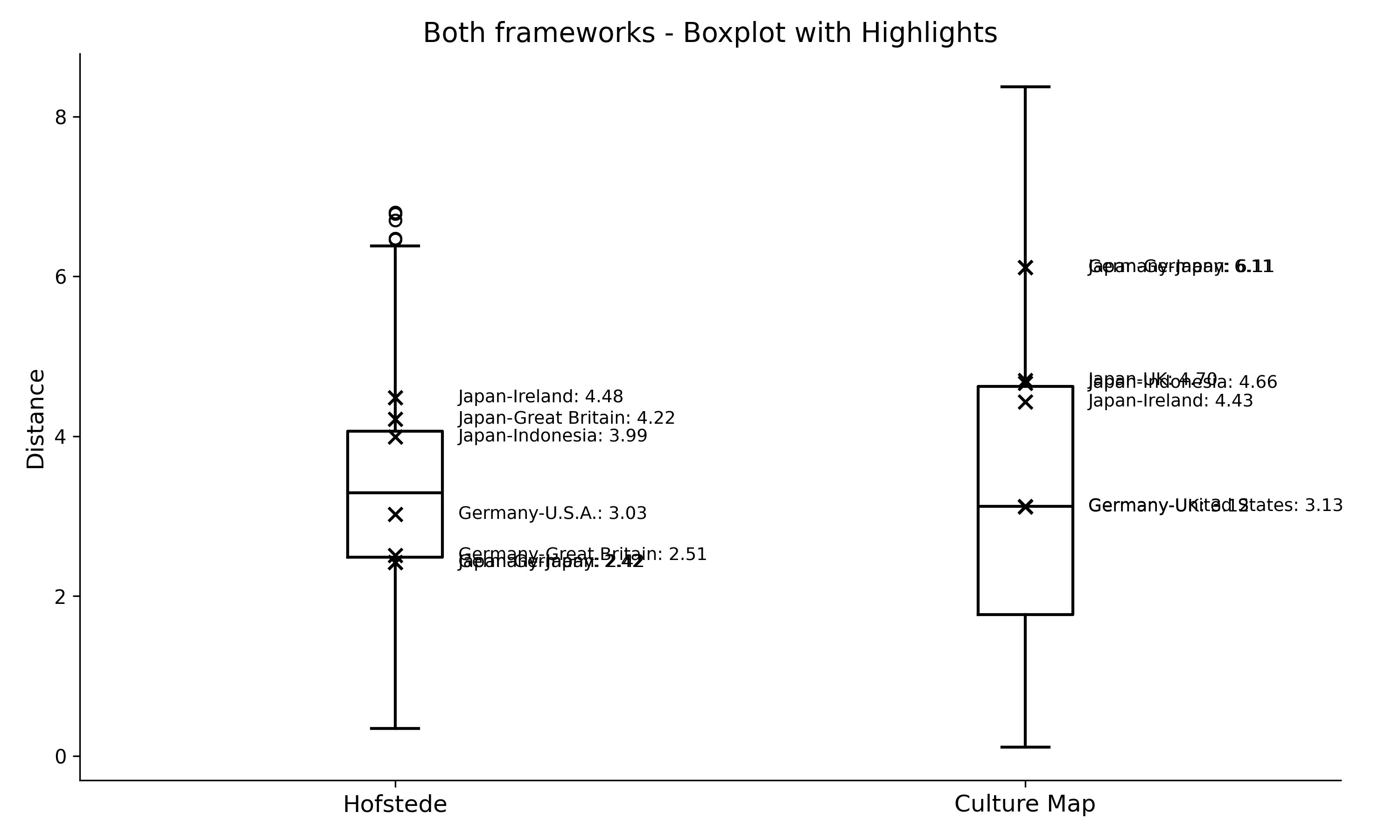

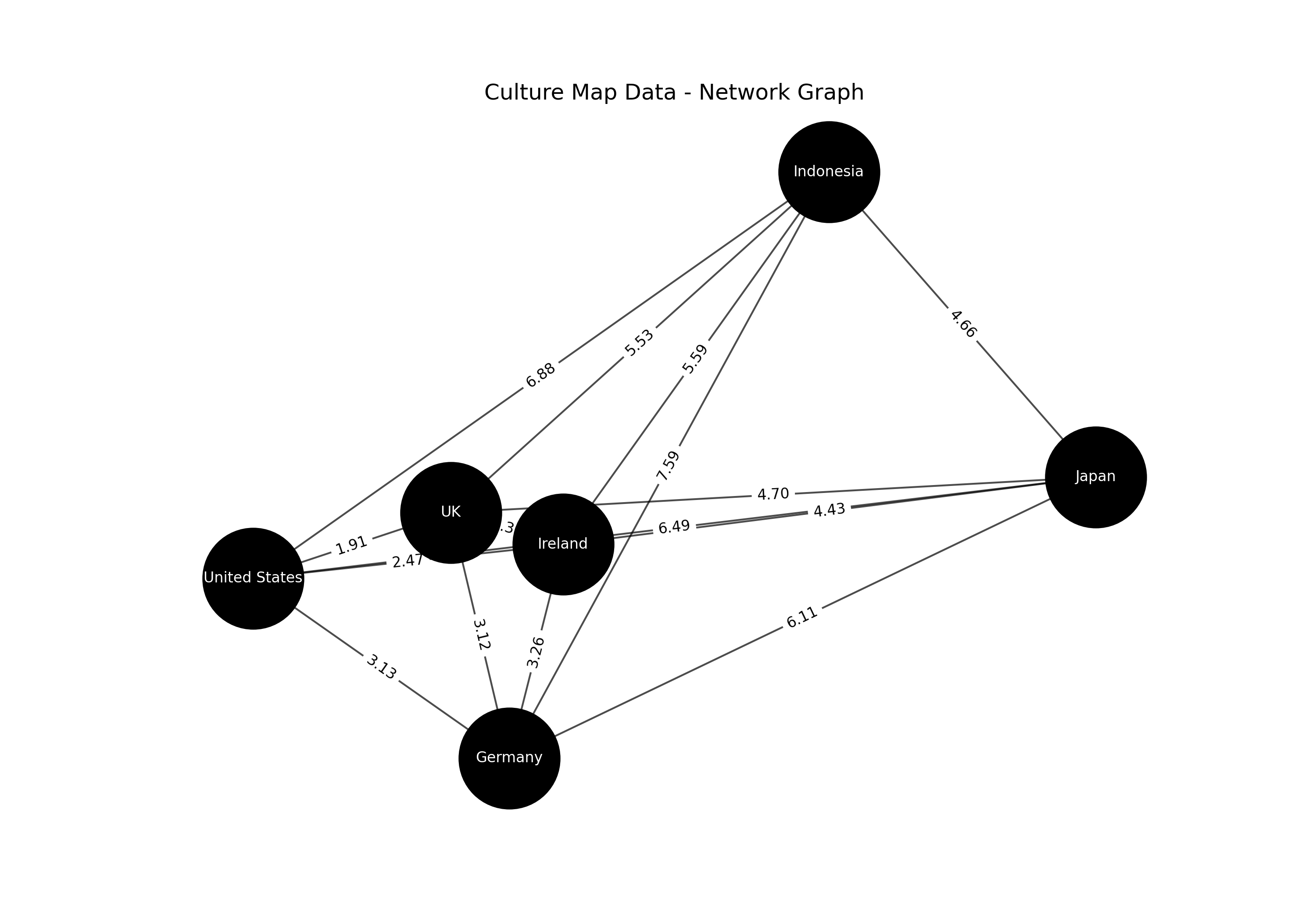

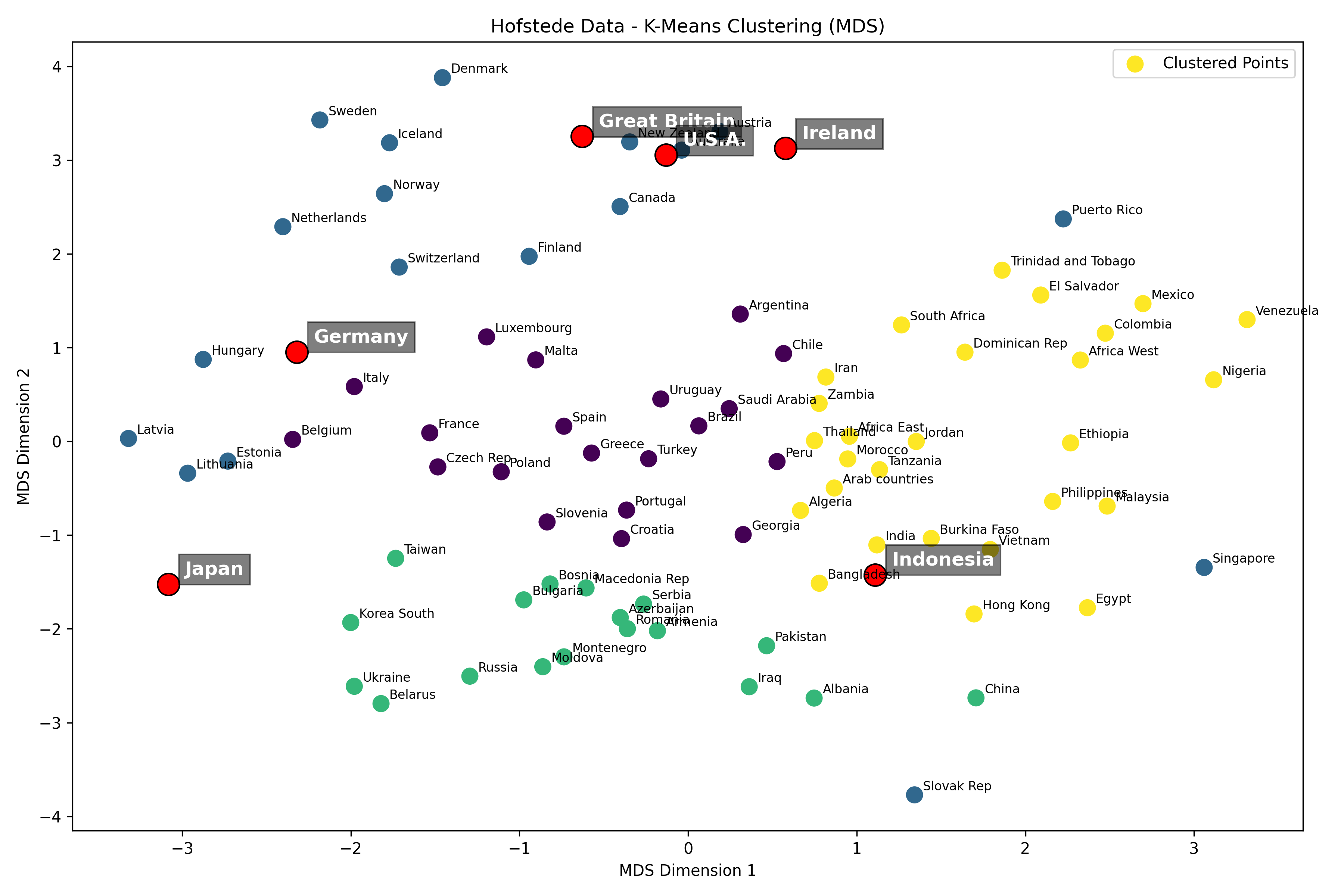

Visualizing Cultural Distance

To measure and illustrate cultural differences between countries, I developed a Python-based analysis software that combines Hofstede’s six dimensions with Erin Meyer’s Culture Map. The program calculates pairwise cultural distances and visualizes them through statistical and network-based plots.

These visualizations were central to interpreting my results, showing where Germany and Japan stand within global cultural clusters.

Comparative Overview

Figure 1: Cultural distances between country pairs using the hofstede and erin meyers dimensions.

Figure 1: Cultural distances between country pairs using the hofstede and erin meyers dimensions.

Cultural Network

Figure 2: A cultural network graph illustrating relative distances between countries using the culture map.

Figure 2: A cultural network graph illustrating relative distances between countries using the culture map.

Clustering

Figure 3: K-Means clustering of cultural distances, trying to visualize cultural distances between countries.

Figure 3: K-Means clustering of cultural distances, trying to visualize cultural distances between countries.

These figures were produced using my own analysis tool, Cultural Distances, which automates data collection, normalization, and visualization for cross-cultural studies. I will cover the software and its methodology in detail in a separate post.

Key Takeaways

- Culture can distort valuation. Hierarchical or collectivist environments may drive symbolic premiums.

- Communication style matters. Implicit vs. explicit negotiation approaches affect information symmetry.

- Integration depends on alignment. Culturally proximate firms integrate faster and more successfully.

- Quantitative frameworks miss nuance. Cultural misalignment can explain deal failures beyond what financial ratios show.

Implications for Practice

For executives and analysts, the research suggests:

- Integrating cultural audits into due diligence

- Assessing leadership communication patterns before negotiation

- Considering national and corporate cultures in synergy forecasts

Reflection

Conducting this thesis between Marburg and Kobe University (Japan)—as part of a MEXT-supported research semester—allowed me to observe how academic theory meets cultural reality.

Japan’s emphasis on harmony and Germany’s on precision provided contrasting yet complementary lenses for understanding global business.

This work strengthened my commitment to bridging European and Asian business practice—where finance meets culture, and strategy meets understanding.

Thesis Title: The Effect of Cultural Distance on Overpayment in Cross-Border M&A

Supervisor: Prof. Dr. Torsten Wulf

Universities: Philipps-Universität Marburg & Kobe University

Keywords: intercultural-management, valuation, german-japanese-business, strategy, finance